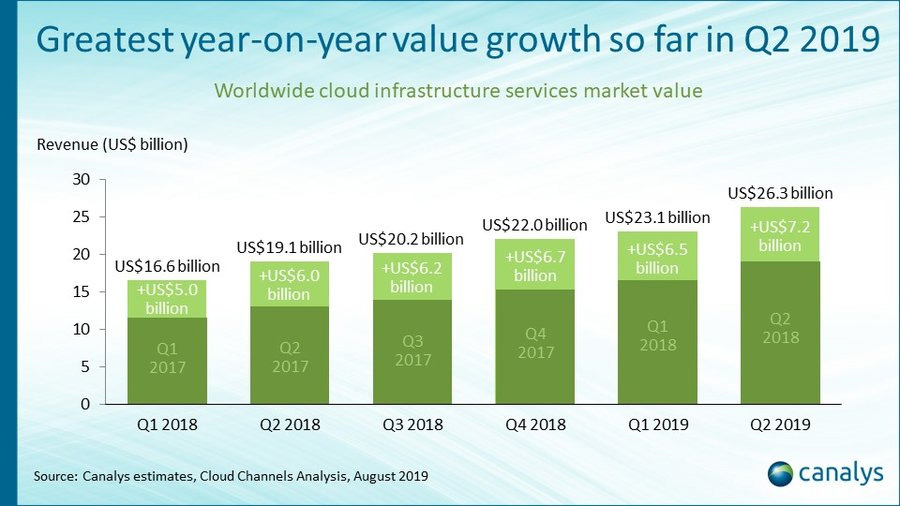

Momentous. The worldwide spend on cloud infrastructure services grew by a very impressive 37.6% year-on-year in Q2 2019, to reach the mark of $26.3 billion.

Registering an $7.2 billion uptick against a year ago, in the process, the biggest ever quarterly increase in terms of value. This continuation of robust cloud spending is, obviously, driven by cloud migration, and the battle for supremacy in this space is set to intensify between the major cloud providers.

All this has been revealed in the latest research by Canalys, part of its updated Cloud Channels Analysis.

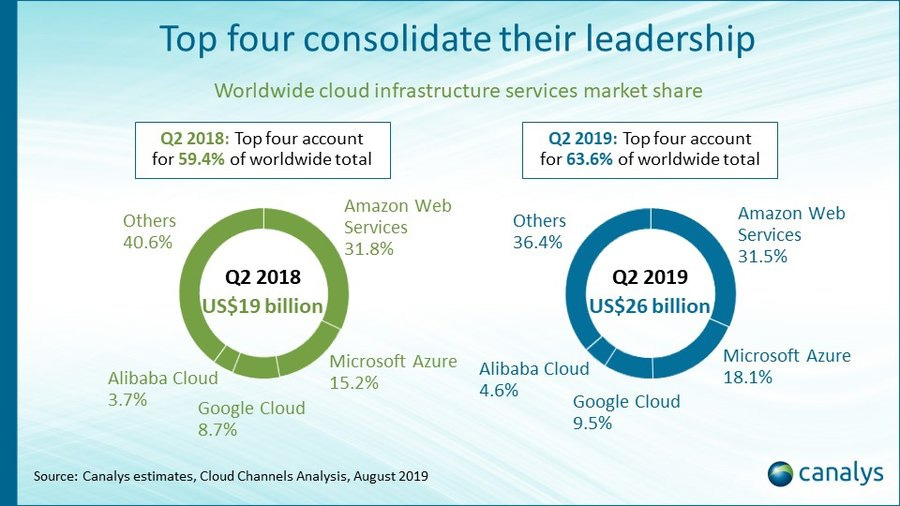

The rankings of the leading cloud service providers remain unchanged, though.

Amazon Web Services continued its domination, growing 36.1% to claim a 31.5% slice of the pie. Microsoft Azure, meanwhile, showcased an even more spectacular jump of some 63.6% growth, and in the process increased its market share by 2.9% to 18.1%.

Google Cloud also gained share slightly to end up with 9.5% of the market, and it is followed by Alibaba Cloud in the fourth position.

As Canalys Chief Analyst Alastair Edwards put it:

“In 2019, the battle for cloud migrations is set to intensify between the major cloud providers. The cloud providers’ channel strategies are increasingly important for tactical advantage and growth, particularly as more customers adopt multi-cloud.”

Despite moderating growth rates for the four major cloud providers, they al saw dollar revenue increase sharply, as they continue to consolidate their dominance of this side of the market.

AWS witnessed the strongest increase in dollar value at $2.2 billion on Q2 2019, but Microsoft Azure was not far behind at $1.8 billion. Speaking of which, Microsoft also enjoyed its biggest ever revenue jump in a quarter for Azure — buoyed by contributions by its channel partners.

The Redmond company remains the leader in the cloud channel, and its dominance is backed by its established Cloud Solution Provider program.

However, the company is not prone to missteps, like the recent ones where it had to reverse unpopular changes to partner benefits. It is hard to maintain rapid growth rates without comprehensive commitments, after all.